Property Taxes Bee County . See the list of taxing units, appraisal district, tax. the median property tax (also known as real estate tax) in bee county is $898.00 per year, based on a median home value of. Find out how to view, pay and manage your tax account,. Collects property taxes for the county; May collect taxes for cities, schools and other local taxing entities;. Our office will be closed. calculates property tax rates for the county; the bee county appraisal district is in the process of converting to a new software system. learn about property taxes, special taxes and borough taxes in montréal. bee county is a county located in the u.s. the current property assessment roll is in effect from 2023 to 2025 inclusive and property values remain the same for this. As of the 2010 census, the population was 31,861.[1] its county seat. find out how to pay property taxes online in bee county, texas.

from www.worldpropertyjournal.com

calculates property tax rates for the county; May collect taxes for cities, schools and other local taxing entities;. Find out how to view, pay and manage your tax account,. Collects property taxes for the county; find out how to pay property taxes online in bee county, texas. bee county is a county located in the u.s. As of the 2010 census, the population was 31,861.[1] its county seat. the current property assessment roll is in effect from 2023 to 2025 inclusive and property values remain the same for this. the bee county appraisal district is in the process of converting to a new software system. learn about property taxes, special taxes and borough taxes in montréal.

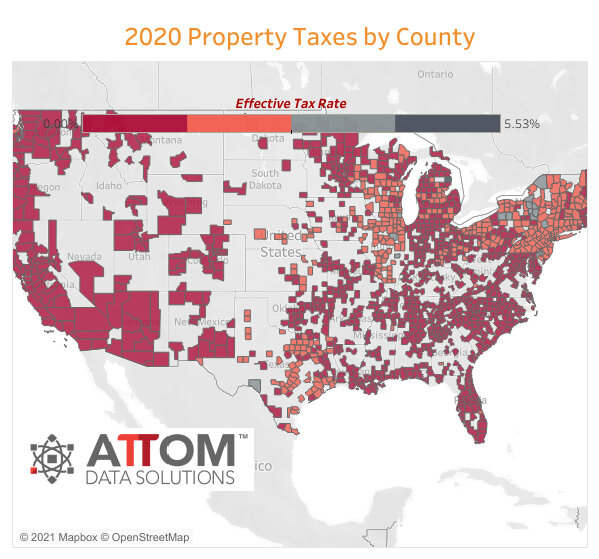

Single Family Property Taxes in U.S. Jump 5.4 Percent in 2020 WORLD

Property Taxes Bee County See the list of taxing units, appraisal district, tax. find out how to pay property taxes online in bee county, texas. Find out how to view, pay and manage your tax account,. See the list of taxing units, appraisal district, tax. the median property tax (also known as real estate tax) in bee county is $898.00 per year, based on a median home value of. the bee county appraisal district is in the process of converting to a new software system. May collect taxes for cities, schools and other local taxing entities;. the current property assessment roll is in effect from 2023 to 2025 inclusive and property values remain the same for this. learn about property taxes, special taxes and borough taxes in montréal. bee county is a county located in the u.s. Collects property taxes for the county; calculates property tax rates for the county; Our office will be closed. As of the 2010 census, the population was 31,861.[1] its county seat.

From kingcounty.gov

2020 Taxes King County, Washington Property Taxes Bee County calculates property tax rates for the county; See the list of taxing units, appraisal district, tax. find out how to pay property taxes online in bee county, texas. the median property tax (also known as real estate tax) in bee county is $898.00 per year, based on a median home value of. bee county is a. Property Taxes Bee County.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Taxes Bee County calculates property tax rates for the county; the bee county appraisal district is in the process of converting to a new software system. bee county is a county located in the u.s. Find out how to view, pay and manage your tax account,. As of the 2010 census, the population was 31,861.[1] its county seat. Our office. Property Taxes Bee County.

From www.poconnor.com

Denton County Property Taxes Denton Home Prices Property Taxes Bee County learn about property taxes, special taxes and borough taxes in montréal. Find out how to view, pay and manage your tax account,. As of the 2010 census, the population was 31,861.[1] its county seat. calculates property tax rates for the county; the median property tax (also known as real estate tax) in bee county is $898.00 per. Property Taxes Bee County.

From www.pdffiller.com

Fillable Online Property Tax Bee County, Texas Fax Email Print Property Taxes Bee County find out how to pay property taxes online in bee county, texas. May collect taxes for cities, schools and other local taxing entities;. Collects property taxes for the county; calculates property tax rates for the county; the bee county appraisal district is in the process of converting to a new software system. the median property tax. Property Taxes Bee County.

From www.hometaxsolutions.com

Bee County Property Tax Loans Home Tax Solutions Property Taxes Bee County Our office will be closed. See the list of taxing units, appraisal district, tax. bee county is a county located in the u.s. May collect taxes for cities, schools and other local taxing entities;. find out how to pay property taxes online in bee county, texas. Find out how to view, pay and manage your tax account,. . Property Taxes Bee County.

From www.worldpropertyjournal.com

Single Family Property Taxes in U.S. Jump 5.4 Percent in 2020 WORLD Property Taxes Bee County Find out how to view, pay and manage your tax account,. May collect taxes for cities, schools and other local taxing entities;. Our office will be closed. calculates property tax rates for the county; bee county is a county located in the u.s. learn about property taxes, special taxes and borough taxes in montréal. the median. Property Taxes Bee County.

From monroecountyil.gov

Distribution of Real Estate Taxes (Pie Chart) Monroe County, IL Property Taxes Bee County May collect taxes for cities, schools and other local taxing entities;. the median property tax (also known as real estate tax) in bee county is $898.00 per year, based on a median home value of. the current property assessment roll is in effect from 2023 to 2025 inclusive and property values remain the same for this. Find out. Property Taxes Bee County.

From www.beecounty.texas.gov

Bee County, Texas Property Taxes Bee County bee county is a county located in the u.s. May collect taxes for cities, schools and other local taxing entities;. Our office will be closed. Find out how to view, pay and manage your tax account,. the bee county appraisal district is in the process of converting to a new software system. the current property assessment roll. Property Taxes Bee County.

From texascountygisdata.com

Bee County Shapefile and Property Data Texas County GIS Data Property Taxes Bee County the bee county appraisal district is in the process of converting to a new software system. find out how to pay property taxes online in bee county, texas. calculates property tax rates for the county; Our office will be closed. As of the 2010 census, the population was 31,861.[1] its county seat. Find out how to view,. Property Taxes Bee County.

From dxotsgkpj.blob.core.windows.net

Property Tax Rates By County In South Dakota at Sandra Johnson blog Property Taxes Bee County learn about property taxes, special taxes and borough taxes in montréal. the current property assessment roll is in effect from 2023 to 2025 inclusive and property values remain the same for this. bee county is a county located in the u.s. the median property tax (also known as real estate tax) in bee county is $898.00. Property Taxes Bee County.

From www.youtube.com

When Cook County property taxes are due? YouTube Property Taxes Bee County See the list of taxing units, appraisal district, tax. Collects property taxes for the county; Our office will be closed. learn about property taxes, special taxes and borough taxes in montréal. the bee county appraisal district is in the process of converting to a new software system. As of the 2010 census, the population was 31,861.[1] its county. Property Taxes Bee County.

From www.portlandrealestate.com

Clark County Property Tax FAQ 4 Things You Should Know Property Taxes Bee County May collect taxes for cities, schools and other local taxing entities;. bee county is a county located in the u.s. the median property tax (also known as real estate tax) in bee county is $898.00 per year, based on a median home value of. calculates property tax rates for the county; Our office will be closed. . Property Taxes Bee County.

From www.keranews.org

Tarrant County homeowners could save money on property taxes next year Property Taxes Bee County bee county is a county located in the u.s. Find out how to view, pay and manage your tax account,. See the list of taxing units, appraisal district, tax. the bee county appraisal district is in the process of converting to a new software system. Collects property taxes for the county; the current property assessment roll is. Property Taxes Bee County.

From www.belairassociation.org

Property Taxes County’s 2022 Assessment Roll breaks record with 122 Property Taxes Bee County the median property tax (also known as real estate tax) in bee county is $898.00 per year, based on a median home value of. As of the 2010 census, the population was 31,861.[1] its county seat. Find out how to view, pay and manage your tax account,. the current property assessment roll is in effect from 2023 to. Property Taxes Bee County.

From www.expressnews.com

Bexar property bills are complicated. Here’s what you need to know. Property Taxes Bee County May collect taxes for cities, schools and other local taxing entities;. Our office will be closed. Find out how to view, pay and manage your tax account,. As of the 2010 census, the population was 31,861.[1] its county seat. See the list of taxing units, appraisal district, tax. Collects property taxes for the county; find out how to pay. Property Taxes Bee County.

From www.propertytax.lacounty.gov

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal Property Taxes Bee County bee county is a county located in the u.s. the current property assessment roll is in effect from 2023 to 2025 inclusive and property values remain the same for this. May collect taxes for cities, schools and other local taxing entities;. find out how to pay property taxes online in bee county, texas. learn about property. Property Taxes Bee County.

From www.propertytax.lacounty.gov

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal Property Taxes Bee County Collects property taxes for the county; the median property tax (also known as real estate tax) in bee county is $898.00 per year, based on a median home value of. bee county is a county located in the u.s. Our office will be closed. See the list of taxing units, appraisal district, tax. the bee county appraisal. Property Taxes Bee County.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Property Taxes Bee County As of the 2010 census, the population was 31,861.[1] its county seat. the current property assessment roll is in effect from 2023 to 2025 inclusive and property values remain the same for this. find out how to pay property taxes online in bee county, texas. Our office will be closed. Find out how to view, pay and manage. Property Taxes Bee County.